Over the past six months, we’ve shared a few posts diving into the healthcare landscape—always seeking solutions to the real storm in our healthcare industry. As Hanukkah’s candles flicker now in December, my wish is to whisper resilience and shine a light on this truly broken system: even in shadows like last weekend’s tragedy and subsidy sunsets, we kindle light, magic, and miracles.

The vision for 2026 coverage: Premiums surging, yet wellness warriors can now unlock 30-40% savings through smart, innovative paths. What’s one “health spark” you’ll ignite next year—maybe a family yoga ritual or MAHA meal swap? Let’s explore the market’s pulse and our empowered moves.

Open enrollment closes in December, with approximately 24.2 million ACA sign-ups for 2025—a record—but 2026’s subsidy cliff (expiring post-Senate stalls) threatens a 114% jump in subsidized payments, from $888 to $1,904 annually. Early data shows 5.8 million enrolled, up 7% from last year, though new sign-ups dipped 4% due to sticker shock.

In California, Covered CA’s benchmark silver premiums rose 10.3%, risking $200+ monthly hits without aid—potentially 660,000 more uninsured. Clients echo the strain: A small business battling 15% group hikes, holidays sidelined; another forgoing $1,200 mammograms on top of the extreme premiums.

Someone said Employer benefits. Family premiums hit $26,993 (+6%), single $9,325 (+5%)—workers shoulder 26% ($6,850 family avg.), steady as wages rose 4%. Holistic vibes surge: 90% mental health coverage, AI wellness personalization, 15% voluntary add-on boom. Level-funded plans grew 20% for savings flex; 82% prioritize total well-being (biosimilars taming Rx creeps). Cheaper than individual markets—audit if eligible for perks like financial coaching, rewards, and discount plans.

So, what do we think can be done? :

Let’s flip it: Make sure to audit EOBs now, every time you get it. Also, remember—spot three “wins” (early screens) and “pains” (copays)—10 minutes could save hundreds through tweaks. Take a closer look at our employer group benefits! This year, they offer lower premiums than what you’d find in the individual market, making them a smart choice for coverage in 2026.

In 2026, we received a potential solution to consider. Don’t miss out on these savings!

Self-Employed/Gig Economy/1099 :

The most comprehensive radical review can now take place in all 50 states.

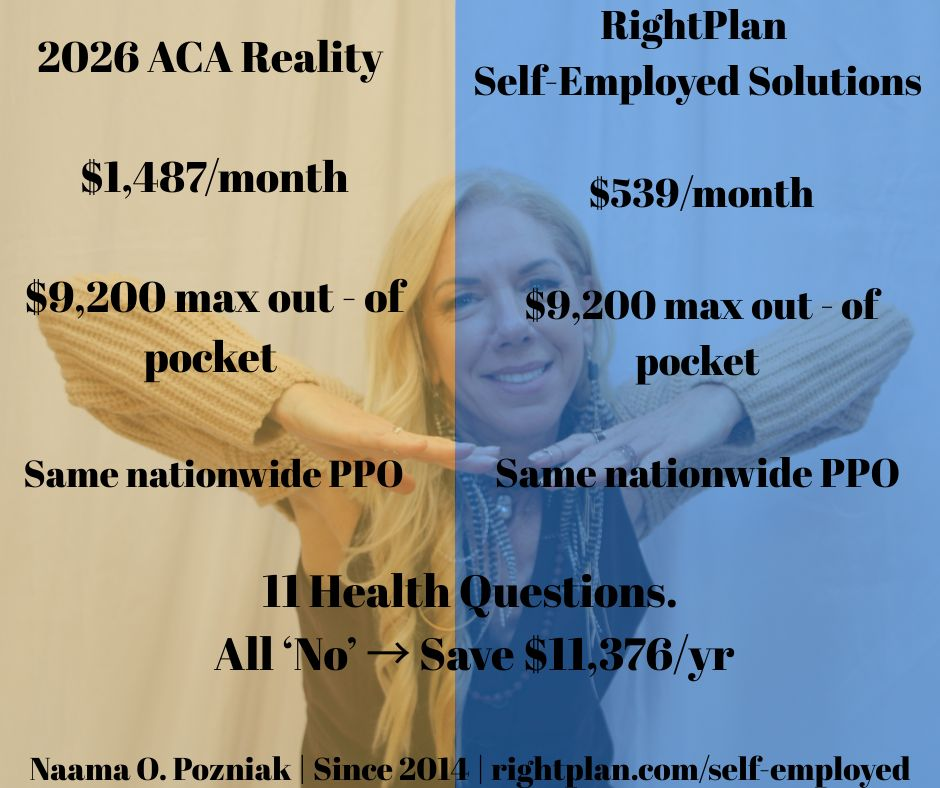

So, if you are under-65 trailblazers: Healthier pull-through captives—self-insured pools for self-employed, 1099s, and small employers in all 50 states, qualify with 11 “No” answers (no tobacco, no complex diabetes/heart issues)? Boom—30-40% premium cuts in wellness-rewarding collectives, born from ’80s employer roots but revved for gig nomads. One client slashed $500/month: some over $1,000/month. Envision that freedom for dream-chasing.

Start at https://rightplan.com/knockout-health-questionnaire/

—Your 2026 edge awaits.

Stay healthy! Get your annual physical, well-woman exam, and colonoscopy routine; it is worth it! It’s finally about to pay off to stay healthy!

In this crisis, solutions shine: Prevention via MAHA, sustainability in care, and new vitality rewards have paid off. My mantra?

Nurture mind, body, spirit—our ultimate coverage.

Grateful for our shared light, let’s manifest 2026 miracles.

With love and many blessings,

Namaste ~ Naama